Days are gone when filing an ITR return was the cumbersome process! now the Income Tax Department has come up with easy to use ITR offline utilities (JAVA or Excel) file which can speed up your process of filing ITR in multiple folds. Now you can download Pre-Filled XML ITR (Income Tax Return) file from Income tax website.

As 31st July is nearby, all of you must be preparing for filing Income Tax return. This year income tax return filing will be very easy for taxpayers. You can download pre-filled ITR XML for ITR 1, 2, 3 and 4 for AY 2019-20. For other ITR it will be launched shortly.

We'll show you step by step how you can speed up your ITR filling process with Pre-Filled XML file

How to Download Pre-Filled XML ITR?

Follow the step by step guide given below to download Pre-filled ITR XML from Income tax website.- Login to Income Tax E-filing portal – https://www.incometaxindiaefiling.gov.in using user ID (PAN card number) and password.

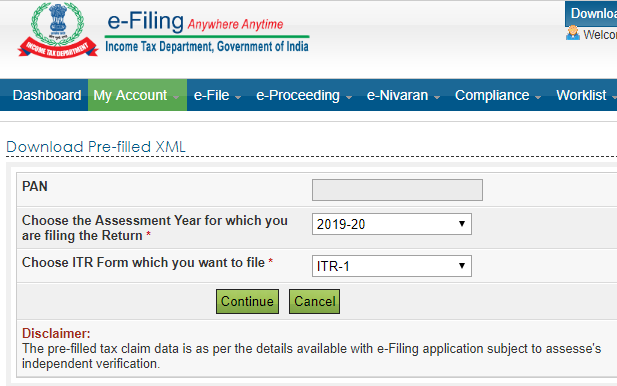

- On the navigation bar click on My Account. You will be able to see various menus. Click on Download Pre-filled XML.

- You will be able to see the following screen asking to select assessment year and ITR form. Kindly select 2019-20 and choose ITR from which you want to file. You have options to select ITR1, ITR2, ITR3, and ITR4.

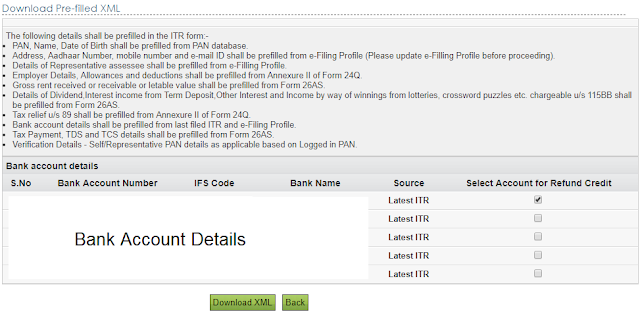

Press the continue button. In the next page, you will be able to see all your bank account. You need to select Account for Refund Credit. Select the account and click on “Download XML” button.

You will be prompted with “Prefill Consent” – I Agree to check all the pre-filled data (personal, income, deductions, bank account details) and make necessary changes to report the correct detail.”

After downloading XML you need to import this XML file to ITR offline utilities JAVA or Excel to prefill details. The downloaded file will have information like

- Personal Information such as PAN, Name, Date of birth shall be prefilled from PAN database.

- Contact details such as Address, Aadhaar Number, mobile number, and e-mail ID will be prefilled from e-filing profile. You need to update your e-filing profile before proceeding.

- Employer details, allowances, and deductions shall be prefilled from Form 24Q, Annexure-II.

- Gross rent received or receivable or letable shall be prefilled from Form 26AS.

- Details about interest from a term deposit, dividend and other income chargeable under income tax law shall be prefilled from Form 26AS.

- Bank Account details shall be prefilled from e-filing profile or past income tax data.

- Tax payment, TDS and TCS details shall be prefilled from Form 26 AS.

After downloading pre-filled XML, logout from the portal.

How You Can Import Pre-Filled XML in ITR Utility?

To file return faster you need to import the downloaded XML file in ITR utility.

Please Go to the download section at Income tax e-filing website and download IT Return Preparation software.

Your ITR form is ready. You need to verify the form completely before processing for ITR filing. Once you find everything in order you can file your ITR online at the Income-tax site.

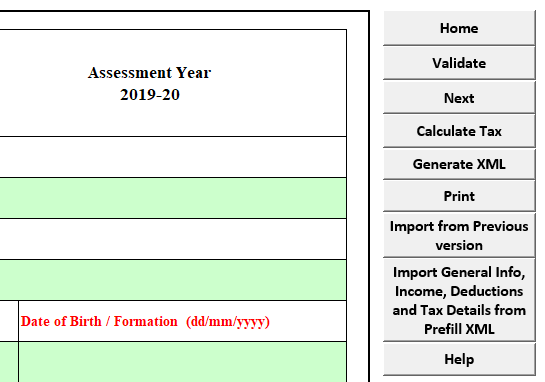

- Once ITR excel utility is downloaded, Open ITR excel utility. In PART – A General Section, you will find a button called “Import General Info, Income, Deductions and Tax details from Prefill XML”. Click on that and you will be warned that this action will overwrite your existing data filled in ITR form. Click on OK button.

- Select the XML file downloaded from Income tax website and you are done.

Your ITR form is ready. You need to verify the form completely before processing for ITR filing. Once you find everything in order you can file your ITR online at the Income-tax site.

So what are you waiting for? File your tax return faster with Pre-filled XML file now!